BrokerHive

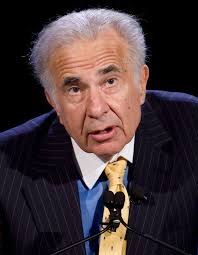

BrokerHiveCarl Icahn was born in New York City on February 16, 1936. He showed a strong interest in business in college and later graduated from Princeton University with a degree in economics. Icahn began his career on Wall Street, working as a stockbroker in his early years and quickly demonstrated a keen insight into the capital market.

In 1968, Icahn founded Icahn Enterprises , through which he began to engage in equity investment and focused on improving corporate governance through "shareholder activism." In the 1980s, Icahn's investment model gradually took shape, and he began to promote corporate value growth by acquiring companies and implementing reform measures, which made him a representative of the image of a "corporate raider."

Achievement

Activist shareholder investment strategy

One of Icahn's most well-known achievements is his use of an activist shareholder investment strategy . He usually becomes one of the company's largest shareholders by purchasing a large number of shares, and then uses the influence of shareholder meetings and the board of directors to make reforms. This strategy has allowed him to successfully acquire a large number of companies, including well-known companies such as TWA , Texaco , and Netflix . Through these acquisitions, Icahn has achieved massive wealth growth.Successful corporate restructuring and governance reform

Through his holdings in multiple companies, Icahn implemented reforms through board control, effectively improving the company's operating efficiency and shareholder returns. His investment successes include pushing up the value of companies such as **Cleveland Cliffs and HP**.Accumulation of Wealth

Carl Icahn’s investments and acquisitions in the financial sector have made him one of the richest men in the world. According to Forbes magazine, Icahn’s net worth once reached tens of billions of dollars, a testament to the success of his investment strategy.Political influence

Icahn has not only left a deep mark on the business world, his investment activities have also given him influence in the political world. Icahn has made political donations to certain candidates in the US presidential election and played a role in White House affairs.

Investment Philosophy

Carl Icahn's investment philosophy is centered around activist shareholders and corporate governance reform . He achieves investment returns through the following methods:

Shareholder Activism

One of Icahn's most famous investment strategies is shareholder activism , which involves acquiring a large number of shares in a company, becoming one of the largest shareholders, and demanding that the company implement major reforms. These reforms usually involve changes in the company's management, divestiture of assets, or restructuring of the capital structure. Icahn believes that only by strengthening corporate governance and increasing transparency can long-term returns for shareholders be improved.Focus on Undervalued Companies

Another of Icahn's investment ideas is to look for companies that are undervalued by the market. Through meticulous research, he found that many companies with potential have not been fully recognized by the market. He acquires these companies, implements improvements, and realizes their potential within a few years, thereby obtaining huge returns.Large-scale acquisitions and divestitures

Icahn's investment style tends to be large-scale acquisitions, especially buying a large proportion of company stocks in the open market . He not only seeks to control companies through acquisitions, but also to increase their overall value by selling bad assets and restructuring companies.

Summarize

Carl Icahn is a financial investor with far-reaching influence. He has changed multiple industries and accumulated huge wealth through radical shareholder investment and corporate governance reform. His success proves that investment is not just about money, but also about a deep understanding and application of corporate strategy, management and governance. Although his investment methods often cause controversy, it is undeniable that Icahn's approach has had a profound impact on the world.

His investment philosophy and strategy made him one of the giants in the financial world and provided valuable experience for countless investors. In the modern capital market, Carl Icahn's success is not only a symbol of wealth, but also a profound reflection on the protection of shareholder rights and corporate governance .